Income Security is not Economic Stabilisation

Why Universal Basic Income and the Job Guarantee solve different macroeconomic problems.

For decades, macroeconomic policy in advanced economies has centered on a narrow orthodoxy. Genuine full employment is treated as inflationary rather than a core objective, with inflation control delegated to central banks through interest rate adjustments. Fiscal policy is considered unsuitable for stabilization, and unemployment is deliberately maintained as a labor market disciplinary tool under the NAIRU paradigm.

The outcomes are difficult to defend: persistent underemployment, regional decay, in-work poverty, precarious labor markets, weak productivity growth, and repeated failures to mobilize available resources. Many experience the economy as something happening to them rather than serving them.

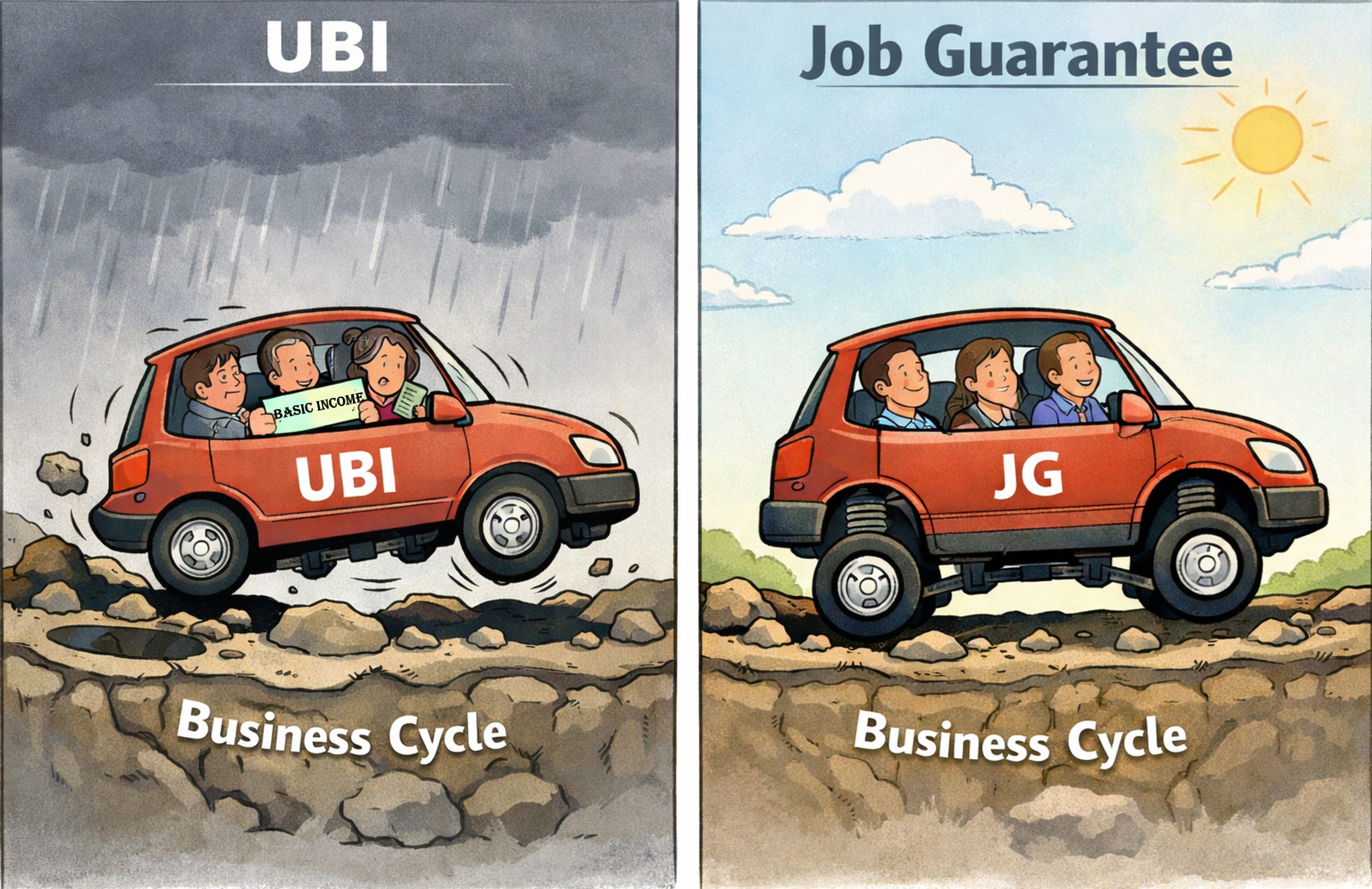

This context has revived interest in alternative proposals. Universal Basic Income (UBI) and the Job Guarantee (JG) — developed within Modern Monetary Theory by economists like Bill Mitchell and Warren Mosler — are often discussed as competing welfare schemes. However, they are fundamentally different. UBI addresses income security; JG addresses macroeconomic stabilization. Confusing the two leads to analytical errors regarding inflation and unemployment’s role.

This essay argues: While UBI has social benefits, it provides no macroeconomic stabilization. A JG does. If we want to replace unemployment as a policy instrument while anchoring wages and stabilizing demand, a JG is essential, not optional.

The Appeal and Logic of Universal Basic Income

UBI is straightforward: every individual receives regular, unconditional cash payments sufficient for basic living needs, regardless of employment or income status.

Philosophical foundation: UBI draws from ideas about freedom from drudgery and critiques of wage dependence. True freedom requires material security. If people must accept any job to survive, freedom is nominal. A basic income provides an exit option, weakens coercive labor relations, recognizes unpaid care work, and removes stigma from means-tested systems.

Practical benefits: UBI is administratively simple, difficult to game, and avoids high marginal effective tax rates in conditional benefits. Evidence from pilots shows it reduces poverty, improves health outcomes, increases educational participation, and helps income smoothing during instability.

Funding constraint: A sovereign currency-issuing government can always make nominal payments; inflation is the relevant constraint. Serious advocates propose fiscal offsets through progressive taxation to manage aggregate demand and ensure price stability.

In principle, this works: if UBI increases spending among high-consumption households and is offset by taxes on low-consumption households, net aggregate demand can be neutral with appropriate tax settings.

The Macroeconomic Limits of UBI

UBI’s fundamental problem is not funding or inherent inflationary pressure; it’s the lack of macroeconomic stabilization. It worsens labor market inflationary risks.

The stabilization problem: UBI is a standing nominal income flow that doesn’t adjust automatically to labor market conditions or business cycles. It doesn’t absorb idle labor during downturns or release labor during booms. When private demand falls and firms shed workers, UBI simply continues paying — unemployment remains the adjustment variable, but UBI dampens disciplinary unemployment effects.

No wage anchor: UBI lacks a nominal wage anchor. It changes reservation wages diffusely and heterogeneously. Some workers demand higher wages; others reduce hours or exit low-quality jobs. While socially beneficial, this doesn’t constitute a coherent wage-stabilization mechanism. There’s no fixed price at which the state hires labor.

Demand pressures: Near capacity, UBI increases spending power across consumption goods. If supply is constrained in housing, energy, healthcare, or childcare, prices rise. Workers defend real wages; wage-price dynamics emerge. The standard policy response reasserts: demand suppression until unemployment rises sufficiently for price stability. UBI doesn’t alter this macro logic but weakens disciplinary effects.

Tax offset challenges: Advocates argue sufficiently aggressive, well-designed tax offsets manage this. But marginal propensity to consume becomes crucial. High-income households save more; removing their income reduces spending less than one pound. Progressive tax increases may need to be large, blunt, and politically difficult — affecting more than top earners. Fiscal adjustments are often slower than inflationary pressures.

Composition fallacy: Small-scale pilots reveal little about national macroeconomic effects. Local UBI experiments operate in open macro environments where prices are externally fixed and labor responses are marginal. Inflation risks are exported; you learn little about true macro impacts from local trials. This fallacy of composition is rarely confronted honestly in UBI debates.

The Job Guarantee as a Macroeconomic Institution

The JG starts differently: unemployment results from policy failure, not market nature. In a monetary economy where government protects currency monopoly, involuntary unemployment reflects insufficient state-supplied credit liquidity for the non-government sector to meet tax obligations and net savings desires. Demand-deficient unemployment is intrinsically a state policy failure.

The logic: The state imposes tax liability payable only in its currency, creating nominal currency demand and monetary unemployment. If the state doesn’t spend enough currency while allowing savings, someone becomes unemployed. Involuntary unemployment is always eliminable by the currency monopolist.

Direct solution: The JG offers standing jobs at fixed nominal wages to anyone willing and able. Work is locally organized, non-competitive with the private sector, and addresses unmet social and environmental needs with additive social value.

The uniform, fixed nominal wage signals the real exchange value of the unit of account into labor — a key production input. If the state pays JG workers a fixed hourly rate, each pound equals a specific quantity of basic labor. The economy’s wage and price structure adjusts relative to this anchor. The JG wage underpins most goods and services’ cost structure as a primary input cost, anchoring the price system.

Important caveat: The JG alone doesn’t control all inflation. It’s necessary but insufficient. Coherent anti-inflation frameworks also require low, stable policy interest rates, strong financial regulation, purposeful credit controls, and direct fiscal intervention for sectoral supply constraints.

Labor market transformation: The JG replaces unemployment buffer stocks with employment buffer stocks. When private demand falls, firms shed workers who flow into JG programs; public spending rises automatically. When demand recovers, firms hire from JG pools; public spending falls automatically. No discretionary fiscal changes required — it’s an automatic countercyclical stabilizer.

The Stabilization Power of the JG

First, high-amplitude countercyclical demand adjustment occurs. Laid-off workers enter JG at living wages (significantly higher than unemployment benefits). When firms recover and bid away JG workers, government spending automatically falls by the same significant amount — steeper fiscal flow changes than unemployment benefit regimes.

Second, spending rises and falls precisely when and where needed. Temporal and spatial responsiveness to real-time market dynamics requires no legislative changes. Geographic weak demand automatically triggers JG wage stimulus without the delays of proxy indicators.

Third, the JG disciplines wage dynamics more effectively than unemployment. Firms prefer habitually employed workers; long unemployment makes people less desirable. The existing paradigm sees firms bidding up wages in wage-wage spirals, countering unemployment’s disciplinary effect.

Conversely, JG work pools of employment-habituated people demonstrate time management and professionalism. Firms increase hiring propensity from this pool. Existing labor faces greater replacement risk, restraining wage demand as employers have better cost alternatives.

On Appearance and Reality

This might seem callous, counter to necessary 21st-century class rebalancing. But this reading abstracts wage discipline from institutional context. The JG fundamentally rebalances labor market power by removing income-loss threats underpinning employer leverage. Discipline emerges not through fear and precarity but through secure, unconditional state-offered alternatives.

Under the JG, workers aren’t compelled to accept poor conditions from desperation — the state offers socially inclusive jobs at fixed living wages, establishing genuine wage and condition floors. Firms cannot push wages below JG standards nor rely on unemployment weakening labor’s position. Simultaneously, firms aren’t forced into aggressively bidding wages during expansions when available workers are employed elsewhere. A maintained, work-ready labor pool shifts adjustment from wage inflation toward JG quantities.

The JG disciplines macroeconomics without disciplining workers. It replaces unemployment’s blunt, asymmetric coercion with symmetric systems where both sides face credible outside options. Workers exit to JG without life-ruining income or dignity loss; firms recruit from employed, integrated, minimally skilled people. The result: stabilized wage-setting within full employment.

Fundamental difference from NAIRU: Orthodox discipline operates through joblessness, income loss, skill degradation, and social exclusion threats. JG discipline operates by fixing bottom labor prices and allowing quantity adjustment. Workers are protected precisely because this system operates without unemployment’s socially destructive dynamics.

Pro-labor essence: The JG is deeply pro-labor, addressing excessive inequality. It secures paid work rights, anchors living wages, preserves human capital, and removes bargaining-structure fear. Better wage dynamics and macroeconomic outcomes aren’t concessions to capital but consequences of designing labor institutions serving public purpose rather than accepting unemployment as acceptable policy.

As President Roosevelt stated regarding his Economic Bill of Rights: “We cannot be content…if some fraction of our people…is ill-fed, ill-clothed, ill-housed, and insecure.” The JG realizes this vision more structurally and stably than UBI.

Social Benefits of a Job Guarantee

Beyond its primary macroeconomic purpose, the JG produces substantial social benefits. Full employment improves income security, mental and physical health, skill retention, and community cohesion. It reduces crime, isolation, and long-term dependency while supporting regional development by mobilizing local labor rather than forcing migration.

With structurally elevated, better-distributed demand, investment flows more easily to previously left-behind regions, particularly with active fiscal state support.

JG participation should be voluntary, but universal optionality is crucial. Unlike workfare, the JG doesn’t punish unemployment; it removes unemployment as a policy-imposed category.

These benefits follow from macro design. Treating the JG as merely large public employment misses the point — it’s a macroeconomic stabilizer first, with social dividends following.

Comparing UBI and the Job Guarantee

Stark contrasts exist. UBI transfers consumption; it redistributes purchasing power and reduces bottom-end poverty and insecurity. However, it doesn’t stabilize labor markets nor anchor wage structures, leaving core macro architecture unchanged and systems vulnerable to inflationary pressures regardless of progressive redistribution.

The JG is a price-setting mechanism. It shifts adjustment from money markets to labor markets, using state-offered zero-bid labor prices to anchor price structures. Under UBI, labor market clearing occurs through employment quantity changes. Under the JG, it occurs through work-location changes. This difference makes the JG stabilizing while UBI is merely compensatory.

Micro vs. macro evidence: Micro evidence suits UBI, revealing behavioral income-security responses. JG micro evidence reveals little about macro effects, which only emerge when universal, permanent, and recognized as default adjustment mechanisms. True efficacy lies in system-wide presence.

Combination problems: Combining UBI with JG, tempting given desires to escape capitalist work structures, likely underperforms JG alone. Guaranteed income independent of work narrows gaps between JG wages and non-employment income, reducing demand flow oscillations across business cycles and therefore reducing stabilization. While complementary income policies are potential levers, trade-offs must be acknowledged rather than ignored. Basic income concurrent with JG only dilutes inflation anchor mechanisms.

Conclusion

Universal Basic Income and the Job Guarantee answer different questions.

UBI addresses consumption security, decent living standards, and freedom from coercion in market societies. It offers morally attractive, administratively simple responses and can contribute to humane social settlements. But it provides no inflation and demand-management answers because it lacks the necessary tools. It says nothing about unemployment’s large real opportunity costs, which persist.

The JG addresses achieving full employment and price stability without unemployment-based discipline. It offers coherent macroeconomic solutions grounded in sovereign currency operational realities, simultaneously achieving many social and economic security goals UBI advocates seek.

If objectives include replacing the NAIRU paradigm, anchoring wages and prices, and stabilizing demand across business cycles, the JG is indispensable. Without it, unemployment remains the system’s silent regulator, however generous layered transfers are.

Serious alternatives to orthodoxy require clarity about these distinctions. Compassion without macroeconomic stabilization sadly proves insufficient and likely fails. The JG provides the necessary structure.

This article was originally published on Jamie Smith’s Substack and is reproduced here with the author’s permission.